MySympleloan.com – Apply for a Personal Loan

Looking for a simple solution to your financial needs? You’ve stumbled upon the right place! At MySympleLoan.com, you’ll find a quick and easy way to apply for a personal loan. We’re here to assist you in securing the funds you need for life’s unexpected or planned expenses. It’s straightforward, it’s convenient, and it’s designed with you in mind. Dive into the world of hassle-free lending with MySympleLoan.com. Let’s explore this together!

Key Takeaways

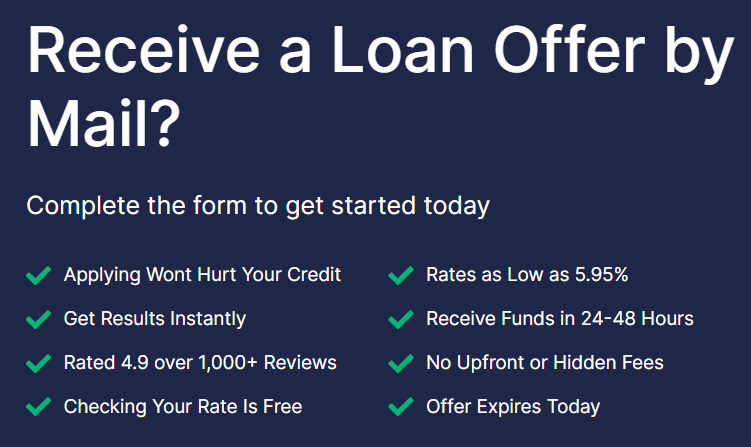

- MySympleloan.com is an online loan provider that offers personalized loan options based on a customized risk-based pricing model.

- The application process for a personal loan at MySympleloan.com is easy and straightforward, with a quick assessment of financial health using advanced algorithms.

- Benefits of getting a personal loan from MySympleloan.com include competitive rates, flexible repayment options, and excellent customer service.

- The loan funds can be used for various purposes such as debt consolidation, home improvement projects, or making large purchases, with tailored solutions to align with individual financial goals.

How Does Symple Lending Work?

You’re probably wondering how Symple Lending works, aren’t you? It’s quite straightforward. Symple Lending operates as an online loan provider, whose mission is to simplify personal lending. When you visit mysympleloan.com, you’ll initiate the process by submitting an application.

What’s important to understand is that Symple Lending credit score requirements are flexible. They use a customized risk-based pricing model that considers more than just your credit score. So, even if your score isn’t top-notch, don’t let that deter you from applying for Symple loans.

After submitting your application, you’ll receive a tailored loan offer. This includes your interest rate and repayment term, both of which are determined by your individual financial circumstances. If you’re satisfied with the offer, you’ll then proceed to finalise the loan agreement.

Once the agreement is signed, funds are typically deposited into your bank account within 24 hours. The entire process is designed to be seamless, accessible, and efficient. That’s how Symple Lending works – it’s all about making personal loans, well, simple. And remember, you’re not just a credit score with Symple Lending. They’re here to help you, regardless of your financial history.

How to Apply for Personal Loan at mysympleloan.com

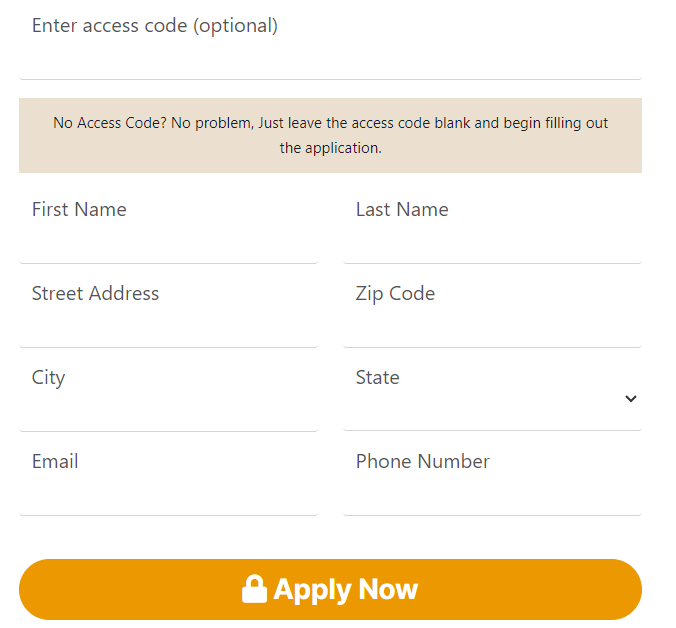

Navigating the online process isn’t as hard as it seems, and within minutes, you’ll have submitted your application for the funds you need. With platforms like wwwsympleloancom, applying for a personal loan becomes a breeze. The site, known for its transparency and ease of use, has built its reputation through positive mysympleloan reviews.

Here’s a step-by-step guide on how to apply for a personal loan at mysympleloan.com: First, you’ll need to provide some basic information. This includes your full name, contact details, and financial information. You’ll also need to state the loan amount you need and your preferred repayment term.

The next stage involves a quick and efficient assessment of your financial health. Symple loan uses advanced algorithms and manual verification to ensure you qualify for the loan. This process, as my symple loan reviews suggest, is fast, and you can expect a response within a few hours.

Once approved, the funds are transferred to your account. Symple loan is all about convenience and speed, making it a popular choice for personal loans. With its straightforward application process, it’s easy to see why.

Benefits of a Symple Personal Loan

There’s a myriad of benefits that come with a Symple personal loan, from competitive interest rates to flexible repayment options. As an online loan provider, mysimpleloan ensures you get the financial help you need without any unnecessary hassle.

Based on numerous Symple loans reviews, it’s clear that customers appreciate the convenience and efficiency of their services. Below is a table that summarizes some of the key benefits you can enjoy with a Symple Personal loan:

| Benefit | Explanation |

|---|---|

| Competitive Rates | Symple offers some of the most competitive rates in the market, ensuring you pay less over time. |

| Flexible Repayment Options | You can choose a repayment plan that suits your financial situation, with options to change it if necessary. |

| Easy Online Application | Applying for a loan is as simple as visiting mysimpleloan and filling in your details. |

| Quick Approval | Once your application is submitted, you can expect a timely response. |

| Excellent Customer Service | You’ll always have someone ready to help you with any queries or issues. |

What Can a My Symple Loan be Used For

With a Symple loan, you can fund a wide range of personal needs, from consolidating debts to renovating your home. The flexibility of a my Symple loan means it can be tailored to align with your financial goals.

Based on the mysympleloan review, here are some uses for a my Symple loan:

- Debt Consolidation: If you’re burdened by multiple high-interest debts, you can consolidate them into a single, manageable payment with a lower interest rate.

- Home Improvement: Whether it’s a kitchen remodel, a new roof, or energy-efficient upgrades, you can use a my Symple loan to enhance your home’s value.

- Large Purchases: From a dream vacation to a new car, a my Symple loan can help you make big purchases without depleting your savings.

Applying for a loan at mysympleloan.com is straightforward and user-friendly. You can trust that Symple lending is legit, offering competitive rates and flexible terms. So, no matter what your financial needs are, consider a my Symple loan as a viable solution. Remember, it’s not just a loan, it’s a strategic financial tool.

How to Contact Symple Loans Customer Service

You’ll find that reaching out to Symple Loans customer service is quite straightforward, and they’re always ready to assist with your queries. The trust mark of their service is their approachability and willingness to clarify all your doubts. When it’s about your hard-earned money, you need to be certain that your lender is genuine.

The legitimacy of mysympleloancom, indeed, has been questioned by some. However, with a solid standing with the Better Business Bureau (symple lending BBB), they’ve proven their credibility. Your ‘my simple loan’ is in good hands with them. They’re not just another faceless lending institution. They are known for their transparency, ethical lending practices, and excellent customer service.

To contact Symple Loans customer service, simply visit their website and navigate to their ‘Contact Us’ section. They’re ready and able to help you with anything related to your loan. Whether you’re inquiring about your loan status, wanting to understand the terms of your contract better, or needing help with repayment options, they’re there for you. Always remember, it’s essential to stay informed and proactive when dealing with your finances.

Frequently Asked Questions

What Are the Eligibility Requirements to Apply for a Loan at Mysympleloan.Com?

You’re asking about eligibility criteria for a loan application. Typically, you’ll need to be 18 or older, have a steady income source, and a decent credit score. You’ll also likely need proof of residence and identification. However, specific requirements can vary between lenders. It’s crucial to understand each lender’s criteria before applying to increase your chances of approval. Always provide accurate information and keep an eye on your creditworthiness.

How Long Does It Take to Receive Funds After My Loan Application Is Approved?

Like a swift summer breeze, once your loan application is approved at MySympleloan.com, you won’t be waiting long for your funds. They’re typically transferred to your account within one business day. It’s a seamless, quick process. So, once you’ve dotted the i’s and crossed the t’s on your application and got the green light, you can practically start counting the hours till you see that money in your account. Just remember, business days don’t include weekends or holidays.

Are There Any Prepayment Penalties if I Decide to Pay off My Loan Early?

No, there aren’t any prepayment penalties if you decide to pay off your loan early. It’s a smart financial move to pay off debt sooner to save on interest. However, always check the terms of your loan agreement. Some lenders may charge a fee for early payment, but it’s not a universal practice. Remember, understanding your loan’s terms and conditions is crucial to optimizing your financial health.

What Happens if I Miss a Payment or Can’t Make a Payment on Time?

If you miss a payment or can’t pay on time, you’ll face penalties. Nearly 5% of personal loans are delinquent. Don’t be part of this statistic! Late fees can escalate quickly, plus you’ll take a hit on your credit score. Dealing with financial difficulties? Reach out to your lender. They may offer a grace period or payment plan. Remember, it’s important to communicate. It’s better to work out a solution than to ignore the problem.

Can I Apply for a Loan if I Have a Bad Credit Score?

Absolutely, you can apply for a loan even if your credit score isn’t perfect. Lenders often consider several factors, not just your credit score. They’ll look at your income, employment history, and debt-to-income ratio. However, you should be aware that a lower credit score could result in higher interest rates. It’s important to understand your financial situation and make sure you’re able to repay any loan you take out.

Conclusion

In conclusion, using mysympleloan.com for a personal loan makes financial sense. Say you’ve got a high-interest credit card debt, a Symple loan can help consolidate that debt into a single, manageable payment with lower interest. Their application process is quick and convenient, and their customer service is top-notch. It’s a smart financial move that simplifies your life and benefits your bottom line.