www.pncpaycard.com – Login to Your PNC Account

Employees with a PNC Bank PayCard can access their debit card account online at www.pncpaycard.com. The card is an alternative way for employees to get paid their earnings from their employer via direct deposit. This process enables employees to get paid faster and much more conveniently.

How to Access Your PNCPayCard Account

To login to your account visit the PNC Paycard website at pncpaycard.com. It’s available 24 hours a day 7 days a week for employees to login. If this is your first time using the site and you’re new to using the card your first step will be to activate your card and setup your online account. Here’s a few steps to getting your card activated:

- Select Activate your Service link on the pncpaycard homepage

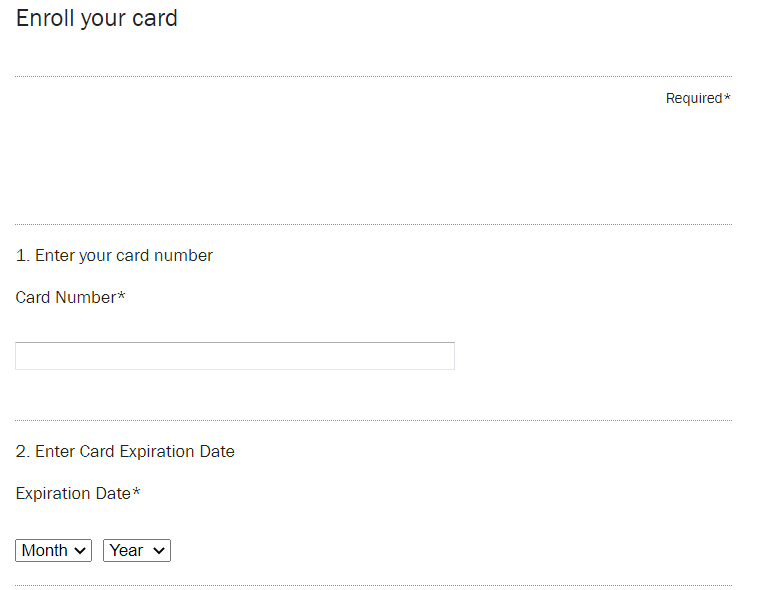

- On the Enroll your card page enter your 16 digit card number, card expiration date, enter 3 digit security code located on the back of your card, enter your Mother’s maiden name, hit Continue button, and proceed with rest of process.

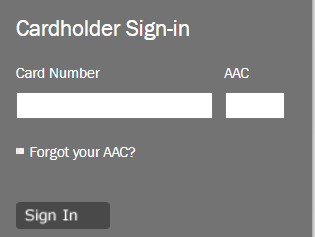

To login to your account after successfully activating your card simply enter in your PNC Bank Payroll card number and the AAC (Account Access Code). Hit the login button and you should be signed into your account.

How to Review PNC Pay Card Balance

The first thing you will notice when logged into your pncpaycard account is your Account Home which displays your balance and current period transactions. You will see the actual date and time of your transactions, description including the location and address of your purchase, and the amount spent.

If you want to see past transactions you will need to select the View Account History button on the left side of the screen. In this section you will notice all of your past transactions in chronological order. You can easily scroll through the list to review your purchases or use the search field to see previous months. It will list up to 30 months of statements for online viewing.

Available PNC Account Home Selections

Other selections you will notice from the Account Home page on the left side of the screen are Change Access Code, Change Address, View Account History, and Logoff. Each section is pretty self-explanatory and easy to understand.

- Change Your Address – The Change Address button on the left side allows you to add or change your personal information. As your info is displayed simply type over the info that needs to be changed in each field and then click Update Address to process.

- Change Account Access Code – change your password to access the website. This number must be 4 numbers and many of the special characters cannot be included.

- Change Address – use this feature to change your personal information at pncpaycard.com such as address, phone number, or email address. To make changes simply type over the old info and replace with the new info then select the Update Address button below.

Contact PNC Customer Service

Employees that need to speak with someone in PNC paycard customer service will need to call 1-866-453-5071. This number is especially for lost or stolen cards or for individuals that need to make changes to their name. When you call the number simply follow the prompts for the option to report a lost or stolen card.

As soon as you discover your card is out of your possession call customer service immediately so you can be issued a brand new card swiftly.

Reference