Www.GetChaseInk.com – Apply for Chase Ink Business Card

When it comes to running a company whether small or large business credit cards can prove to be very valuable for your many financial needs. They not only assist with building up your credit rating but they are also very essential to keeping the business going. One of the most popular business cards available to business owners is the Chase Ink Cash or Plus Business card.

How to Apply for Chase Ink Credit Card

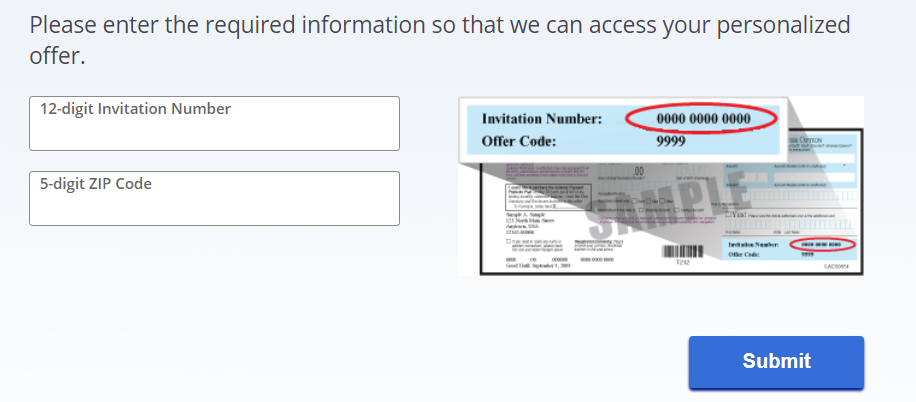

If you received an invitation in the mail to apply for one of these credit cards visit their online application site to complete the short online form.

- Visit www.getchaseink.com

Enter the following info:

- 12 digit Get Chase Ink invitation number

- 5 digit zip code

- Click the blue Submit button

Be prepared to continue on with the rest of the Get Chase Ink online application process which will require you entering more personal info such as:

- Employer

- Social security number

- Phone number

- Salary

- Mortgage or rent amount

When you finish completing the getchaseink application and click the Submit button the next step is to wait for an instant decision. The instant decision should take a minute or so to complete.

Since you’ve already been preapproved for the credit card due to Chase previously checking your basic credit history the application process is a formality to ensure you’re working and producing income.

Get Chase Ink Business Unlimited Card Features

- $750 bonus cash back after spending $7,500 within the first 3 months

- 1.5% cash back unlimited

- 0% intro APR for 12 months from the beginning

- Redeem for cash back rewards

- No additional cost for employee cards

- Fraud protection

- Purchase protection

- Personalized account alerts

- Earn up to 100,000 points annually on business referrals

Chase Ink Cash Business Card

- $300 bonus cash back after spending $3,000 within first 3 months of applying at getchaseink.com

- 0% intro APR for 12 months on purchases and balance transfers

- No annual fee

- Earn 5% cash back on the first $25,000 spent in combined purchases office supply stores and on cellular phone, landline, internet, and cable TV services each account anniversary year.

- 2% cash back on the first $25,000 in combined purchases from gas stations and restaurants each account anniversary year

- 1% unlimited cash back on all other purchases

- Earned points do not expire as long as your account is open and they can be redeemed for cash back, travel, and gift cards.

Chase Ink Plus Business Card Highlights

- Earn 60,000 bonus points after spending $5,000 on purchases within the first 3 months

- $750 accounts towards travel rewards when redeemed through Chase Ultimate Rewards

- No foreign transaction fees

- $95 annual fee for cardholders

- 5 points are earned per each dollar on the first $50,000 spent in combined purchases at office supply stores, cellular phones, landlines, internet, and cable TV services each account anniversary year.

- 2 points are earned per $1 on the first $50,000 spent in combined purchases at gas stations and hotel accommodations if purchased directly to the hotel each account anniversary year.

- 1 point is earned per $1 on all other purchases and is unlimited.

Overview of Applying Online

If you received an invitation to apply for a Chase Ink Plus Business Credit Card be sure to locate the 12-digit invitation number on the mailer you received. You will need to enter that number along with your 5-digit zip code on the homepage of www.getchaseink.com.

After that just complete the online application which only takes a few minutes and at the end you’ll receive an instant decision on your acceptance along with your credit limit.

This is the recommended way to apply for a credit card because its fast in comparison to completing the paper application and mailing it back. It can take up to 7 days to know if you’ve been approved while the online application is instant.

www.getchaseink.com