www.citizensonepersonalloans.com – Prequalified For Loan

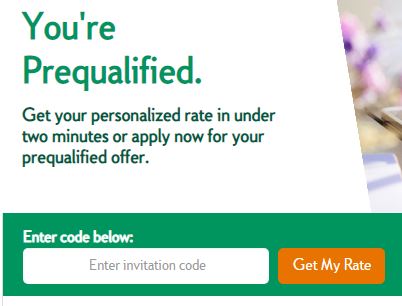

Citizens One customers that are prequalified for a personal loan can receive a personalized rate in two minutes or less. This offer is especially for customers that received an invite to apply for a loan.

From the loan application website users can get all the details about their loan before accepting or simply apply for a loan as usual.

Citizens One Personal Loan Invitation Code

The first step to applying for a loan online is to locate the 12 digit invitation code that you received in your mailer or email then follow instructions below:

- Visit www.citizensonepersonalloans.com

- Enter your 12 digit invitation code

- Click the orange Get My Rate button

- Complete the short application to receive your terms

- Choose to accept loan

If you are ready to apply for a Citizens One loan and would like to skip the preliminaries click the OR Apply Now link at www.citizensonepersonalloans.com. You will be redirected to a personal loan application that will need to be completed. You will need to enter the following personal details:

- Name

- Date of birth

- Social security number

- Address

- Email address

- Phone number

- Annual income

- Employment status

- Answer if renting or own

- Input loan amount

- Input intended use of loan

- Click orange Continue button

- Customize loan terms

- Receive acceptance or denial of loan

Applicants that may have any questions about the loan or loan process can call customer service at 1-855-782-8199.

Citizens One Unsecured Personal Loan Highlights

The main points about this loan is most individuals that know about it have been invited to apply. This means your financial background has already been assessed and you’ve been chosen as a candidate that qualifies for a loan. Here are other tidbits of info about the loan:

- No fees

- Low fixed rates

- Loans from $5,000 to $50,000

- Borrow only what you need

- Get a quick credit response – required documents can be e-signed and uploaded for easy and efficient closing

- Customize your repayment options – choose your repayment term for customizing your monthly payment amount

- Interest rates range from 7.99% to 16.24%

- Minimum income is $24,000

- Credit report will be checked and shown as inquiry

Most consumers inquire about a personal loan to pay off any high interest credit cards or loans to save money on interest and reduce their monthly payment. Customers also use a loan for home improvement projects, making large purchases, and to take a vacation that may be on the bucket list.

Reference