Lib1st.Com – Apply for Liberty First Lending Personal Loan

Are you skeptical about applying for a personal loan online? Well, let us put your mind at ease. With lib1st.com, applying for a Liberty First Lending personal loan is quick, easy, and secure. You can access the application process from the comfort of your own home, eliminating the hassle of visiting a physical branch. So, why wait? Take control of your finances and apply for a Liberty First Lending personal loan today.

Key Takeaways

- Quick and easy application process

- Accessible from the comfort of your own home

- Competitive interest rates

- Flexible loan terms

What is a Liberty First Debt Consolidation Loan?

A Liberty First Debt Consolidation Loan is a type of loan offered by Liberty First Credit Union that allows you to combine multiple debts into one single loan with a lower interest rate. This loan is designed to help you simplify your finances and save money on interest payments. With a Liberty First Debt Consolidation Loan, you can pay off your debts faster and achieve financial freedom.

What are the Liberty First Lending Personal Loan Benefits?

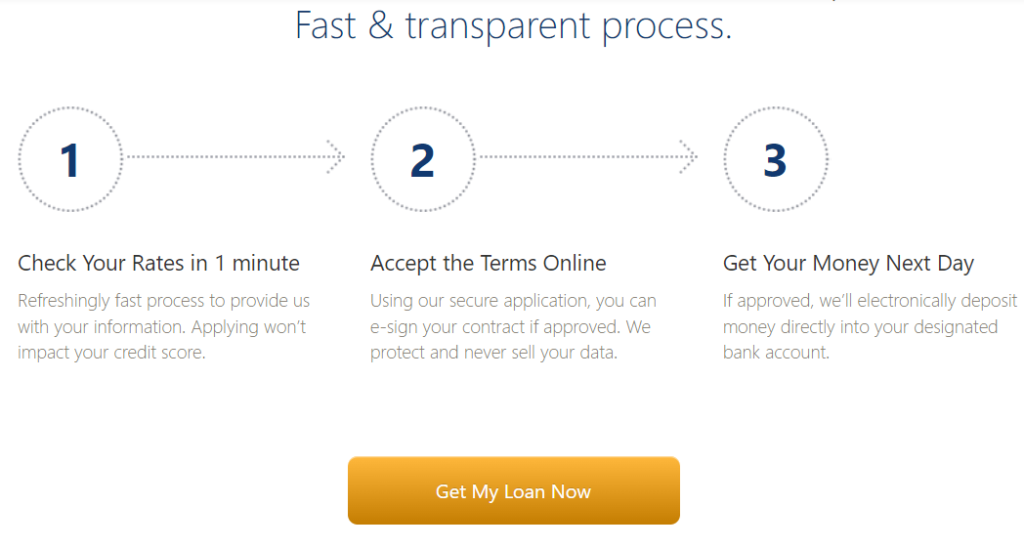

You’ll love the Liberty First Lending Personal Loan Benefits. When you apply for a personal loan with Liberty First Lending, you can enjoy a range of advantages. Liberty First Lending offers flexible loan terms, allowing you to choose a repayment period that suits your needs. With competitive interest rates, you can save money on your loan. The application process is quick and easy, with a simple online application available on libertyfirstcredit.com.

If approved, you can receive your funds in as little as one business day. Liberty First Lending also provides personalized customer service, ensuring that you have access to assistance throughout the loan process. So why wait? Take advantage of the benefits of a Liberty First Lending Personal Loan today by visiting lib1st.com.

How Do I Apply for Liberty First Lending Offer at lib1st.com

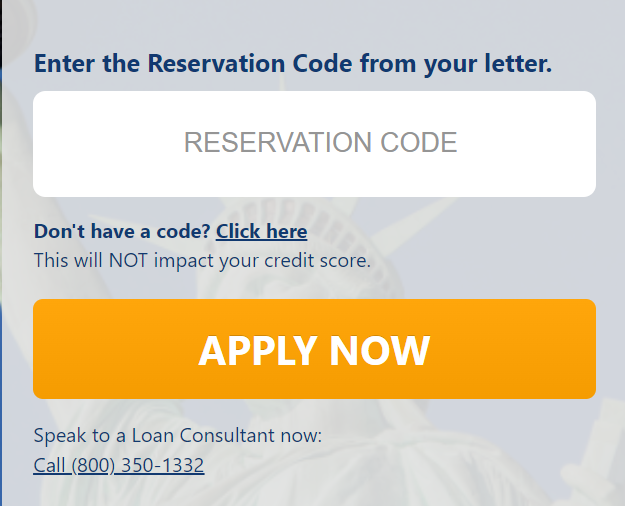

To apply for a Liberty First Lending offer at lib1st.com, you will need to visit their website and locate the application form. Fill out the required information, including your personal details, employment information, and financial information. Once you have completed the application, submit it online for review and consideration.

If you’ve received a pre-approval offer in the mail locate the lib1st.com reservation code on your offer letter. You will need this code to enter on the application site. Enter the number then click the orange Apply Now button. The next step will require you to enter personal information leading in the online application process.

What is Required to Apply?

Before submitting your application for a personal loan with Liberty First Lending, make sure you have all the required documents and information ready. To apply for a personal loan on lib1st.com, you will need to provide basic personal details such as your name, address, and contact information. Additionally, you will need to provide information about your employment status, income, and any existing debts or financial obligations. It is important to have accurate and up-to-date information to ensure a smooth application process.

In some cases, you may be required to submit supporting documents such as proof of income, bank statements, or identification documents. By having all the necessary information and documents ready, you can streamline the application process and increase your chances of being approved for a personal loan from Liberty First Lending.

How do I Contact Liberty First Lending Customer Service

If you have any questions or concerns, feel free to reach out to Liberty First Lending’s customer service. Liberty First Lending understands the importance of providing excellent customer service and is dedicated to assisting you with any inquiries you may have. There are a few ways you can get in touch with their customer service team. One option is to call their phone number, which can be found on their website or any correspondence you may have received from them. Their knowledgeable representatives are available during business hours to answer your questions and address your concerns.

Another convenient way to contact Liberty First Lending’s customer service is through text messages. Simply send a text to the designated customer service number and a representative will respond as soon as possible. Additionally, you can also reach out to them through the contact form on their website. Rest assured that Liberty First Lending is committed to providing you with the support you need throughout your loan application process.

Frequently Asked Questions

What Are the Eligibility Requirements for a Liberty First Debt Consolidation Loan?

To be eligible for a Liberty First debt consolidation loan, you need to meet certain requirements. These may include having a good credit score, a steady income, and a low debt-to-income ratio. Additionally, you may need to provide documentation such as proof of income and identification. It’s important to note that specific eligibility criteria may vary, so it’s best to visit the Liberty First website or contact their customer service for detailed information on the requirements for their debt consolidation loan.

How Long Does It Take to Get Approved for a Liberty First Lending Personal Loan?

Getting approved for a Liberty First Lending personal loan is a breeze. The process is quick and efficient, ensuring you won’t be kept waiting. You’ll receive a decision in no time, allowing you to move forward with your financial goals. So, whether you’re looking to consolidate debt or fund a major purchase, rest assured that Liberty First Lending has got you covered. Apply today and experience the ease of approval for yourself.

Can I Use a Liberty First Debt Consolidation Loan to Pay off Credit Card Debt?

Yes, you can use a Liberty First debt consolidation loan to pay off credit card debt. This type of loan allows you to combine multiple debts into one, making it easier to manage and potentially saving you money on interest. By paying off your credit card debt with a debt consolidation loan, you can simplify your finances and potentially lower your monthly payments. It’s important to carefully consider the terms and interest rates of the loan before applying.

What Is the Interest Rate for a Liberty First Lending Personal Loan?

The interest rate for a Liberty First Lending personal loan is competitive and can vary depending on various factors such as your creditworthiness, loan amount, and loan term. It’s important to note that Liberty First Lending offers personalized loan options to suit your individual financial needs. By applying for a loan through Lib1st.com, you can explore the available options and find the interest rate that best fits your situation.

Are There Any Fees Associated With Applying for a Liberty First Lending Personal Loan?

Yes, there are fees associated with applying for a Liberty First Lending personal loan. It’s important to note that the specific fees can vary depending on the loan amount and terms. However, common fees may include an application fee, origination fee, and processing fee. These fees are typically disclosed upfront, so you can make an informed decision before proceeding with the loan application.

Conclusion

Applying for a Liberty First Debt Consolidation Loan at lib1st.com is a simple and convenient process. With their excellent customer service, you can easily get in touch with their team for any assistance you may need. Take control of your finances and experience the freedom of financial stability with Liberty First Lending.