www.mycoverageinfo.com – Review Insurance Policy Information

With MyCoverageInfo, you can manage your active insurance accounts online. The portal keeps track of a customer’s credit details and handles all subsequent processes on their behalf. Home insurance and home loans are available to customers when they purchase a property. Your insurance information is also received through the MyCoverageInfo portal.

MyCoverageInfo Account Features

- Review policy information

- Update evidence of insurance

- Submit new policy documentation

How to Search for Your Loan at MyCoverageInfo

Before logging in and getting started with using the website you will need a few account details that’s required as you’re using MyCoverageinfo – here is what you will need:

- Visit www.mycoverageinfo.com

- Loan number

- Insurer name

- Agent name

- Insurance number

- Policy effective date

- Premium amount and coverage

- Pin

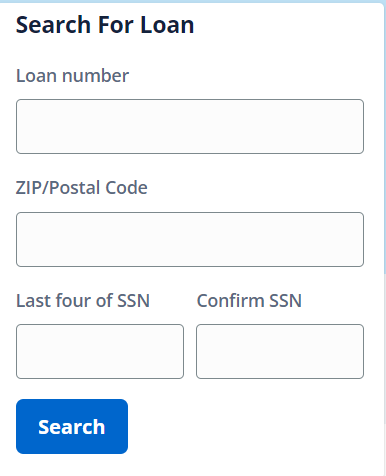

How to Login to MyCoverageInfo

- Enter your loan number

- Enter your zip code

- Enter the last 4 digits of your social security number

- Confirm your social security number

- Click the blue Search button

The Features Inside Your Account

As you are logged in to your MyCoverageinfo account you will be able to make edits including:

- Update your agent details

- Insurance information

- Personal information

- Credit information

- Insurance policy details

With MyCoverageInfo, you can also claim your insurance and deal with your insurer. MyCoverageInfo allows you to update your credit information and your insurance policy details.

If necessary, the portal will inform the insured or intermediary of the evolution of your insurance policy.

Answers to Commonly Asked Questions

How does Lender Insurance work?

Having insurance for your property is a requirement of your mortgage agreement. A lender will purchase Lender Placed Insurance (LPI) if they do not have proof of adequate insurance. Generally, LPI policies are more expensive and do not include liability or content insurance. In the event of an increase in premiums, your mycoverageinfo.com monthly mortgage payment will reflect it.

Did I approve an insurance payment?

Your preferred insurance provider receives your security deposit payments from us. Payments are made promptly when we receive invoices from your supplier so that there is no insufficient coverage for you. Sometimes, an agent will send you an invoice for approval before you approve it. Contact your carrier or agent if an invoice was sent to us in error.

Is it possible to get a refund for my insurance policy if I cancel it?

Your current insurer must be contacted to cancel your policy. Your unused insurance premium will be refunded.

Reference

www.mycoverageinfo.com