Avantcard.com Offer Code – Avantcard Pre-Selection Offer

Imagine sifting through your mail, you find an envelope with a bold ‘Pre-Selection Offer’ written on it from AvantCard for you to apply online using your avantcard.com offer code. Your heart skips a beat as you wonder what this could mean for your financial future. After all, the prospect of gaining access to more credit is always intriguing and potentially beneficial if used wisely. This pre-selection offer from AvantCard signifies that you have been identified as a potential candidate for their Mastercard product based on certain criteria.

You’re likely brimming with questions – What does this offer entail? How do I qualify for an Avant Mastercard? And how would I go about activating my card? Don’t worry; we’ve got you covered! In this article, we’ll walk you through everything you need to know about responding to an AvantCard Pre-Selection Offer.

We’ll guide you step by step on how to apply for the card, activate it and even provide tips on how to contact AvantCard’s customer service should you have more questions or concerns. Buckle up because we are about to embark on a detailed journey into the world of AvantCards!

How to Qualify for an Avant Mastercard

While it’s generally straightforward to qualify for an Avant Mastercard, you’ll need a fair credit score and a steady income source, making it essential that you’ve got your financial ducks in a row. Your first step should be understanding the credit score requirements set by Avant.

They typically look for applicants with scores ranging from 600-700, but they also consider other factors like your income and debts. Remember, improving your credit score doesn’t happen overnight; it requires responsible financial management.

Next up is familiarizing yourself with Avant’s eligibility criteria beyond just the credit score. For instance, being at least 18 years old (21 in Puerto Rico) and having a valid Social Security number are mandatory prerequisites. Additionally, Avant prefers applicants who have a low debt-to-income ratio and demonstrate good financial management habits.

It might not hurt to review some financial management tips such as paying bills on time, keeping balances low on other credit cards, and not applying for too much new credit simultaneously.

Now let’s talk about one of the major Mastercard benefits – the potential for high credit limits! With Avant Mastercards offering up to $5,000 depending on your individual circumstances and approval process outcomes, this could be an excellent opportunity if you’re looking to consolidate high-interest debts or cover larger purchases responsibly. While this limit is enticing remember that managing this limit wisely is crucial to maintaining good standing with Avant and building towards future financial goals.

How to Apply for an Avant Credit Card

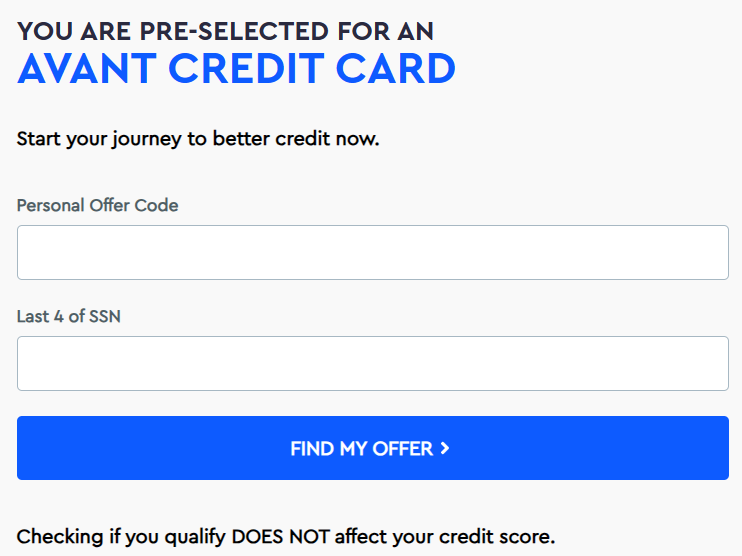

If you’ve received a pre-selection offer and are ready to apply for an Avant Credit Card, the process is straightforward. Start by using your unique Avantcard.com offer code. This vital step ensures that your application aligns with their pre-approval process, setting you up for success in obtaining your new credit card.

Use Your Avantcard.com Offer Code

Ready to unlock the benefits of your pre-selected offer? Simply use your Avantcard.com offer code, and let’s get this financial journey started together. The offer code benefits are attractive and many; from exclusive promotions to special rates, each code is designed with your financial well-being in mind.

It’s all part of the AvantCard promotions strategy – rewarding customer loyalty with tangible financial advantages that make a real difference in your life. You’ll also find securing Avantcard codes is easy and straightforward: once you’re pre-selected, the code retrieval process is as simple as checking your email or logging into your account.

Remember, these exclusive Avant offers are just for you. They’re a sign of how much we value our relationship with you and want to provide options that cater specifically to your needs. Now let’s delve into what makes these codes so worthwhile:

- Offer Code Benefits: These codes give access to a host of benefits such as lower interest rates, higher credit limits and waived fees.

- Lower Interest Rates: Enjoy reduced interest on purchases and balance transfers which can save you significant amounts over time.

- Higher Credit Limits: This could potentially improve your credit score by lowering your credit utilization ratio.

- Waived Fees: Some codes may waive annual fees or late payment penalties, saving you additional costs.

- Code Retrieval Process: After being pre-selected, simply check your email or log into your account for easy retrieval of the offer code.

- Securing Avantcard Codes: Rest assured knowing that securing these unique codes is safe and secure; they are sent directly via email or available within the confines of your personal account.

Take advantage of these exclusive Avant offers using your personalized offer code today!

How Do I Activate my Avantcard

You’d think activating your Avantcard would be as complex as deciphering an ancient script, but surprisingly, it’s just a few simple clicks online. The Card Activation Process is designed to be user-friendly and straightforward. To get started, all you need is your card in hand and access to the internet. You can initiate the process either through their website or via their mobile app for added convenience.

Just login into your account, find the ‘Card Activation’ option, input your card details as prompted and follow the instructions on-screen. This Online Activation system ensures that you can start enjoying AvantCard Features such as cash back rewards and competitive interest rates in no time.

While this process is generally smooth sailing for most users, sometimes glitches happen. If you run into any issues during activation – maybe the website isn’t loading properly or there seems to be an error with your card details – don’t fret! That’s where Activation Troubleshooting comes in handy.

Simply contact Avantcard’s customer service team who are available round-the-clock to provide guidance and resolve any problems promptly. They can walk you through common troubleshooting steps or escalate more complex matters if needed.

Now let’s discuss Mobile App Activation because it offers even more flexibility in managing your finances on-the-go with Avantcard. Just ensure that you’ve downloaded the official app from Apple Store or Google Play Store depending on your device type, then log in using your credentials provided by Avantcard upon registration of your account online.

Once logged in, navigate to ‘Card Services’ then select ‘Activate Card’. Input required information such as card number and expiration date then submit for activation request processing – easy peasy! Remember: having control over our finances should not be complicated; instead it should empower us towards achieving financial freedom – something that activated Avantcards certainly help facilitate!

How to Contact my Avantcard Customer Service

Feeling overwhelmed with questions or encountering issues with your card? Don’t worry, because reaching out to the dedicated customer service team at Avantcard is a breeze! Whether you’re dealing with payment queries, card security concerns or just want to learn more about AvantCard benefits, they’ve got you covered. Their support team is knowledgeable on all aspects of their services and products and are committed to resolving complaints swiftly and effectively.

For the best customer support experience, consider these tips:

- Always have your account details at hand when contacting customer service. It makes it easier for them to assist you.

- Be clear and concise about your issue. The more specifics you can provide, the quicker they can resolve your complaint.

- If you’re inquiring about AvantCard benefits, ask for an explanation on how each benefit works so that you can fully utilize them.

- For payment queries, don’t hesitate to ask for a detailed walkthrough on how their payment process works.

- When discussing card security issues, inquire about proactive measures that Avantcard takes to protect its customers against fraudulent activities.

Remember that Avantcard’s primary goal is ensuring that all its customers are satisfied with their services. So whether it’s a question about your bill statement or a desire to understand more on maximizing the use of your card’s features, there’s always someone ready to help at the other end of the line.

You are not alone in navigating through any challenges or making informed decisions about using AvantCard’s financial products – their expertly trained customer service representatives are just one call away!

Frequently Asked Questions

What should I do if I lose my AvantCard or if it gets stolen?

If you find that your AvantCard has been lost or stolen, it’s crucial to prioritize card security by reporting the loss immediately. You should contact AvantCard’s customer service as soon as possible to prevent unauthorized transactions and engage in fraud prevention. They will guide you through their replacement procedure, which usually involves canceling your current card and issuing a new one.

Keep an eye on your account for any unusual activities and report them promptly, as this can aid in tracking down fraudulent charges if any have occurred. Remember, taking swift action is key in situations like these to protect yourself against potential financial harm.

Can I increase the credit limit on my AvantCard?

Yes, you can request an increase to your AvantCard credit limit. This process is known as a limit evaluation and it involves assessing your financial management skills, responsible borrowing habits, and the potential impact on your credit score. The credit extension is not guaranteed and depends on several factors including your payment history, income level, and overall debt load.

It’s crucial to remember that while having a higher credit limit may offer more spending flexibility, it also requires careful financial management to avoid unnecessary debt or negatively impacting your credit score. Always strive for responsible borrowing by only utilizing what you need and making timely repayments.

How can I earn reward points with my AvantCard?

Did you know that, on average, credit card users only redeem about 50% of their earned reward points? Don’t let this be you! With AvantCard, there are several points accumulation strategies to maximize your rewards. One way is through shopping with AvantCard partners; these benefits can yield a significantly higher point rate per dollar spent than regular purchases. Just ensure you understand the reward tiers as higher tiers usually offer a better return rate on your spending.

When it comes to reward points redemption, it’s not just about accumulating points but also making sure they’re used wisely – whether for travel discounts, cashback offers or gift cards from popular retailers. Also crucial to remember is the points expiry policy – don’t leave your hard-earned points unused for too long or they might expire. Stay strategic and informed and make the most out of every point earned with your AvantCard!

Can I use my AvantCard for international transactions?

Absolutely, you can use your AvantCard for international transactions. However, it’s important to be aware of potential Foreign Transaction Fees that may apply when making purchases abroad. Additionally, AvantCard provides International Purchase Protection to safeguard your transactions from any fraudulent activities. So, even if you’re halfway across the world, you have coverage!

The Currency Conversion Rates used by AvantCard are competitive and ensure that you get a fair exchange rate on your purchases. Also included in the AvantCard Travel Benefits is International Fraud Protection which helps detect and prevent unauthorized activity on your card. So, with AvantCard, international spending is not only possible but also secure and beneficial!

How can I set up auto-pay for my monthly AvantCard bills?

Setting up auto-pay for your AvantCard bills is not only convenient but also comes with various benefits like ensuring timely payments, avoiding late fees, and maintaining a good credit score. The enrollment process is quite straightforward: log into your account online or via the mobile app, navigate to ‘Manage Payments,’ and select the ‘Auto Pay’ option. From here, you can schedule your payments according to your preference – be it on the due date or a specific day of each month.

It’s important to monitor these automated payments regularly to troubleshoot any issues that may arise with auto pay such as missed payments or double charges. Remember, even though you’ve set up auto-pay, managing your payments effectively remains crucial in maintaining control over your finances and avoiding unnecessary surprises on your bill.