How to Apply at brightlending.com/mailoffers for Personal Loan

Bright Lending emerges as a beacon for those seeking financial relief through personal loans. As an online lender, it offers an expedited avenue to secure a bright loan, distinctively positioning itself amidst the plethora of financial products. This comprehensive exploration delves into the nuances of applying for a Bright Lending loan at brightlending.com/mailoffers, managing your loan online, and navigating the customer support landscape.

Benefits of Applying Online for brightlending.com/mailoffers Loan

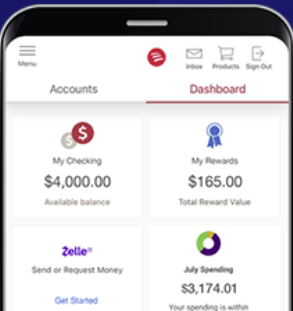

Applying for a loan online with Bright Lending offers the immediacy and convenience that traditional banks or credit unions may not match. This tribal lender, operating under the sovereignty of the Fort Belknap Indian Community, extends installment loans that are accessible via a simple online service. Bright Lending’s digital platform eliminates the need for physical interactions with debt collectors or the traditional in-person application form hassles. However, potential borrowers should be aware of the high APRs associated with payday loans and small loan products offered by tribal lenders.

| Benefit | Description |

|---|---|

| Fast Funding | Loans are often processed and funds deposited into the borrower’s bank account as early as the next business day, providing swift financial assistance. |

| Simple Online Application | The online service simplifies the application process, allowing borrowers to apply from anywhere without the need for physical paperwork or in-person visits. |

| Flexible Loan Amounts | Bright Lending offers a range of loan amounts, giving borrowers the flexibility to choose a loan that best suits their financial needs. |

| Direct Deposit | Loan funds are directly deposited into the borrower’s bank account, ensuring immediate access to the funds for urgent financial needs. |

| Transparent Terms | All loan terms, including APRs, repayment plans, and any potential fees, are clearly outlined before finalizing the loan, promoting informed borrowing decisions. |

| No Traditional Credit Check | Bright Lending may offer loans without a traditional credit check, making it accessible for individuals with less-than-perfect credit scores. |

| Tribal Lender Benefits | As a tribal lender, Bright Lending operates under the sovereignty of the Fort Belknap Indian Community, offering unique loan products. |

| Customer Support | Bright Lending provides dedicated customer support service, assisting borrowers with any questions or concerns throughout the loan process. |

| Repayment Flexibility | Borrowers are offered various repayment plans to suit their financial situation, helping manage loan repayments effectively without undue stress. |

| Secure Online Platform | The application and account management processes are conducted on a secure online platform, protecting personal and financial information. |

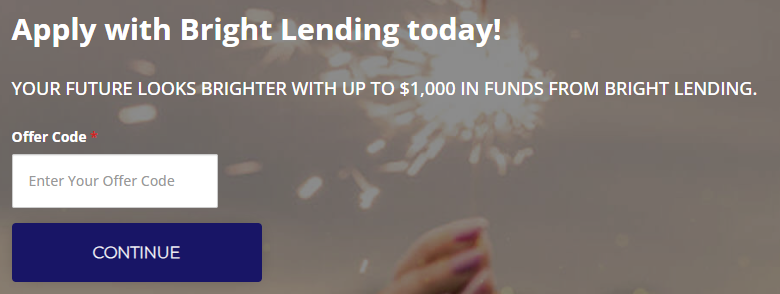

How to Use Bright Lending Offer Code to Apply Online

Utilizing an offer code for a Bright Lending loan online simplifies the application process, propelling you toward financial resolution as early as the next business day. Upon receiving a mail offer, applicants can enter their unique code on the website, thereby personalizing their loan amount and terms. This streamlined approach ensures that funds are promptly deposited into the borrower’s bank account, subject to the due date and repayment plans outlined.

- visit brightlending.com/mailoffers

- enter your offer code found on your offer letter

- click the Continue button

You should receive an online application that has been pre-filled which will expedite your application time. Complete all the fields on your application and at the end click Submit. You will receive an instant decision.

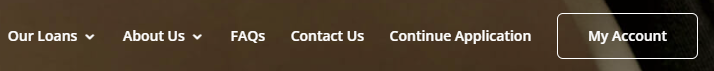

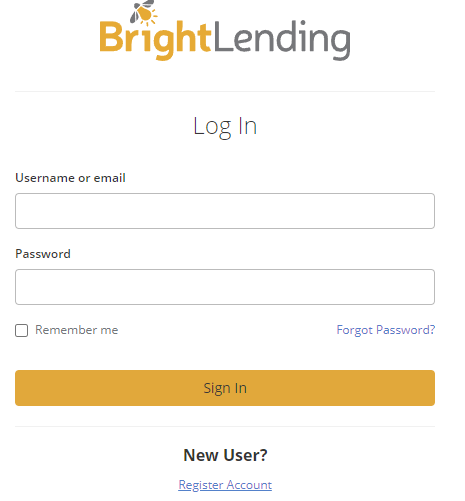

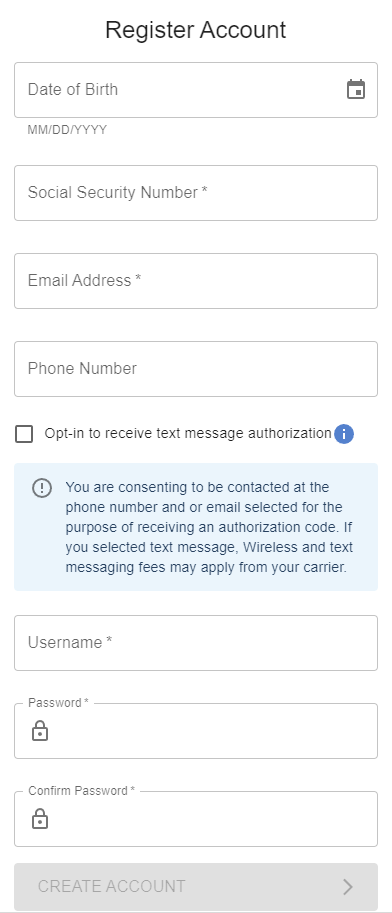

How to Register for an Online Bright Lending Account

Registering for an online account with Bright Lending enhances the borrower’s ability to manage their loan efficiently. Through this online portal, customers can review loan details, track repayment progress, and communicate with customer support service. Nancy Torrez, a representative of the Indian tribe, emphasizes the importance of such digital tools in fostering a transparent lender-borrower relationship, grounded in the regulatory authority guidelines of the United States.

- visit brightlending.com

- at the top right corner of the screen click the My Account button

- click the Register Account link at the bottom of the page

- enter your date of birth, social security number, email address, and phone number

- create your username and password

- click the Create Account button

How to Make A Payment

Bright Lending’s commitment to convenience extends to its repayment process. Borrowers can easily make payments through the lender’s online service, directly from their bank account. This method not only ensures timely debt settlement but also mitigates the risk of engaging with debt collectors or facing a lawsuit for non-repayment. Bright Lending provides various repayment plans, accommodating different financial situations and preventing the accumulation of credit card debt or the need for debt validation letters.

You can pay by ACH draft from your bank account on your due date (new and returning customers receive 25 percentage points off of the APR), or send a personal check, cashier’s check, money order, or certified check to the address below on or before your due date.

Payment address:

P.O. Box 578

Hays, MT 59527 United States

How to Contact Bright Lending Customer Service

For inquiries, application form assistance, or debt collection concerns, Bright Lending’s customer support service stands ready. Operating from the Belknap Reservation, this tribal lender’s team can be reached through multiple channels, ensuring borrowers have access to the ultimate guide for managing their loans. Reviews on platforms like Trustpilot and the Better Business Bureau highlight Bright Lending’s responsive customer service, reflecting its commitment to addressing borrower needs and queries.

Customer Service:

Self-Service selfservice.brightlending.com

Phone 1-866-441-7674

Email customerservice@brightlending.com

Mailing Address

PO Box 578, Hays, MT 59527

Who is Bright Lending?

Bright Lending is not just an online lender; it’s a financial ally offering personal loan lenders an alternative to traditional payday loans and high-interest credit lines. As a tribal lender affiliated with the Fort Belknap Indian community, Bright Lending operates under the legal framework of tribal sovereignty, offering installment loans with specific interest rates. This personal loan review reveals Bright Lending’s role in providing small loans to those in need, with a focus on transparency, regulatory compliance, and borrower empowerment.

In summary, Bright Lending offers a viable option for individuals seeking to borrow money online. From the ease of applying with a bright lending loan offer code to the simplicity of making payments and accessing customer support, Bright Lending prioritizes borrower convenience and financial autonomy. While the high APRs and the nature of being a tribal lender necessitate careful consideration, Bright Lending remains a noteworthy choice for those exploring personal loans and debt settlement solutions in the United States.