Ally.com/Activate – Ally Debit Card Activation

If you’ve just received a new debit card from Ally Bank, you’re likely eager to start using it. But there’s one important step you need to take first: activating your card at ally.com/activate. Activation is a security measure banks use to ensure that the correct person has received the card before it can be used. Without activation, your debit card is essentially useless, so it’s crucial to handle this task promptly upon receiving your new card.

We understand that financial processes like these can sometimes seem complicated or daunting. Don’t worry – we’re here to guide you through the steps of activating your Ally Bank debit card both online and over the phone.

We’ll also help troubleshoot common issues encountered during activation and highlight some benefits of having an activated debit card ready for use. If you encounter any hiccups along the way, we’ll provide information on how to contact Ally Bank support for assistance. Let’s get started on ensuring that your banking experience with Ally is smooth and hassle-free!

Steps to Activate Your Card Online at Ally.com/Activate

You’re just a few clicks away from activating your Ally Bank debit card online, let’s dive into the steps! Firstly, ensure you’ve met all the activation prerequisites. You’ll need to have an existing Ally bank account to link your card to and access to secure internet connection for optimal online security. Your shiny new debit card should arrive by mail with a unique card number, expiration date, and CVV security code on it, which you’ll need during the setup.

visit ally.com/activate

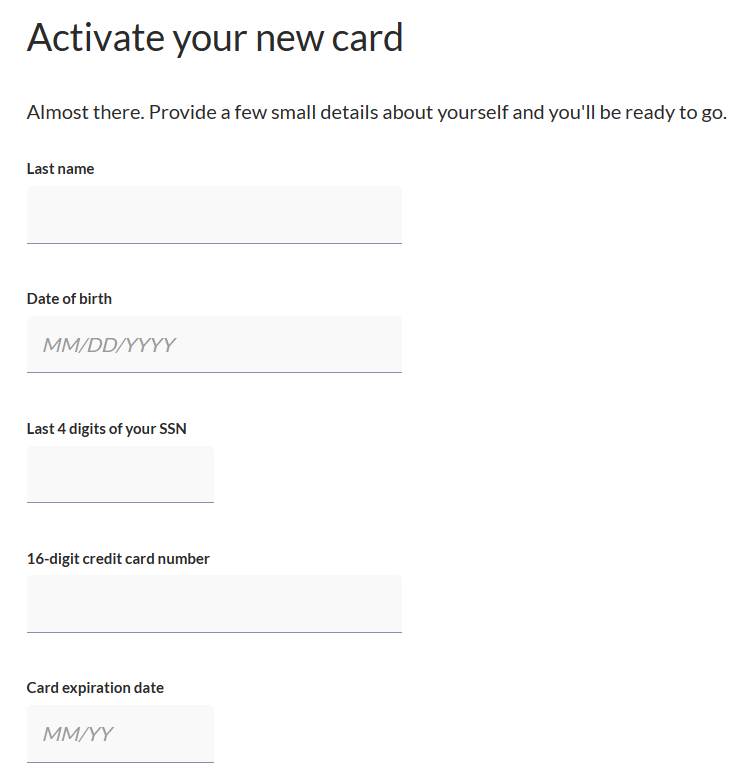

enter the following details:

Last name

Date of Birth

Last 4 digits of your social security number

16 digit credit card number

Card expiration date

click the blue Continue button

Once you’ve submitted these details correctly, wait a moment while the system verifies them. This shouldn’t take more than a few moments – after which you should receive an activation confirmation notification either through email or text message (based on your preference). Congratulations!

Your Debit Card Features are now ready to use: ATM withdrawals, direct deposits from employers or government agencies, contactless payments at stores – whatever suits your banking needs best! Remember always safeguarding that Online Security we talked about earlier? It applies here too – make sure not to share any of these details with anyone else for ensuring top-notch financial safety.

How to Activate Your Ally Bank Debit Card via Phone

Worried about how to get your plastic money up and running? Don’t fret, you can easily set it in motion with a quick phone call. Ally Bank provides a hassle-free Phone Activation Process that gets your debit card ready for use in no time. The first step is to dial the number printed at the back of your card. This connects you directly to Ally Bank’s automated system which guides you through the activation process.

During this process, crucial attention is paid to Phone Activation Security as well as Customer Verification Methods. You’ll be required to verify your identity by providing some personal details like your Social Security Number (SSN), date of birth, or any other information linked to your account. This ensures that only authorized users activate cards and safeguard customer’s financial information against possible frauds.

The Activation Call Duration varies depending on individual circumstances but typically lasts just a few minutes. Once all necessary inputs have been provided correctly, the system immediately activates your card making it ready for transactions. For non-English speakers or those who prefer another language, there are Language Options Available during the phone call; simply follow the prompts to select your preferred language option for an easy and comfortable experience while activating your Ally Bank Debit Card over the phone.

Troubleshooting Common Issues During Ally Bank Debit Card Activation

Encountering hiccups while setting up that shiny new piece of plastic? It’s completely normal, and we’re here to help you navigate through any common issues that might pop up. Dealing with “card decline reasons”or “unsuccessful activation causes”? Don’t fret. These are often due to simple oversights like entering incorrect data during the ally.com/activate process or network issues. Sometimes your card may not activate because it has been damaged, in which case contacting Ally Bank for a replacement is your best bet.

Here’s a quick table breaking down some common problems and their solutions:

| Problem | Solution |

| Incorrect information entered during activation | Double-check all the information you’ve entered, including your card number, expiry date, and security code. |

| Network or server error | If you’re activating online or via mobile app and experience an error message, try again later when internet connection is stronger. |

| Card damage | If your card appears physically damaged or worn out, contact Ally Bank for a replacement |

While troubleshooting these “activation error solutions”, remember that patience is key. Keep track of any “card activation queries”you have so that if needed, you can easily communicate them to customer service representatives at Ally Bank who are more than willing to assist you overcome these activation hurdles.

Remember, it’s okay if things don’t work out perfectly the first time around – sometimes technology can be finicky! Just keep trying different methods until something works for you. And if all else fails? You always have the option of reaching out directly to Ally Bank’s customer service team for further assistance in activating your debit card. They’re well-equipped and ready to help sort out any remaining bumps on your path towards successful debit card activation!

Benefits of Your Activated Ally Bank Debit Card

Once you’ve conquered the activation process online at ally.com/activate, there’s a world of perks waiting for you with that little piece of plastic! Your Ally Bank debit card isn’t just your key to accessing your funds; it also opens up an array of exclusive benefits. As a member of the Ally family, you’re privy to top-notch financial services that set the standard for modern banking.

1) Cashback Rewards: With every swipe of your activated Ally debit card, cash back rewards pile up. These are essentially bonus points that can translate into real money or discounts on purchases in certain categories. It’s like getting paid to spend!

2) Digital Wallets: In this era of mobile technology, carrying physical cards is becoming passe. Your Ally Bank debit card integrates seamlessly with digital wallets like Apple Pay and Google Pay, allowing for contactless payments from smart devices – easy peasy!

3) Safety Features: You can rest assured knowing your money is safeguarded by state-of-the-art safety features. From chip technology to fraud monitoring systems, every transaction is encrypted and secure. If lost or stolen, your card can be immediately frozen using Mobile Banking apps to prevent unauthorized use.

4) Overdraft Protection: Ever been embarrassed by declined transactions due to insufficient funds? Say goodbye to those awkward moments with Overdraft Protection which covers shortfall in checking accounts up to a certain limit.

So next time you reach out for that shiny new Ally Bank Debit Card after its successful activation, remember all these perks lined up at your disposal. Think about how Cashback Rewards help save while spending or how Digital Wallets make transactions hassle-free and super quick! Take comfort in the advanced Safety Features ensuring every penny stays safe and finally revel in the security blanket provided by Overdraft Protection against accidental slips-ups. Remember – it’s not just a debit card; it’s a tool for smarter banking!

Contacting Ally Bank Support for Debit Card Activation Issues

If you’re hitting a snag with that pesky plastic pal of yours, don’t fret – the Ally support team is just a call away, ready to lend a hand like knights in shining armor. This team prides itself on their swift Support Response Time and high-quality Customer Service Quality. Whether it’s day or night, weekday or weekend, they’re there to assist you in your moment of need. When you reach out to them regarding an issue with your debit card activation, they’ll surely put their best foot forward to provide the assistance you require.

The Issue Resolution Process at Ally Bank is designed with your convenience in mind. When you report any Technical Issues with your debit card activation, the support representative will first guide you through a Security Verification process for your protection. This could involve answering some security questions related to your account or confirming personal details that only you would know. After verifying your identity and ensuring your account’s safety, they will then proceed to diagnose and rectify the problem at hand.

Ally Bank takes its reputation for stellar customer service very seriously; therefore, every effort is made to ensure that issues are resolved promptly and effectively. You can expect clear communication from their end throughout the process as they work diligently towards resolving any glitches hampering your debit card activation. Remember that no issue is too big or small for them – if it matters to you, it matters to them! So next time you’re having trouble getting that new debit card up and running, remember there’s always help readily available from Ally Bank’s dedicated support team.

Frequently Asked Questions

What should I do if I lost my Ally Bank Debit Card before activating it?

Immediately report your lost card to Ally Bank Support. They’ll initiate the Card Replacement Process and expedite Debit Card Shipping. If needed, utilize their Emergency Card Services for immediate access to funds while you wait.

Can I use my Ally Bank Debit Card in foreign countries?

Yes, you can use your Ally Bank debit card abroad. Be mindful of foreign transaction fees and the currency conversion process. To avoid card blocking issues, follow the travel notification procedure. Check ATM accessibility too.

How can I set up a PIN for my new Ally Bank Debit Card?

You can set up your PIN security during the card activation process in online banking. If you encounter issues, Ally’s customer support and mobile alerts system will guide you through each step with ease.

What are the fees associated with using an Ally Bank Debit Card?

Navigating the world of banking can be tricky. With your Ally Bank debit card, you could potentially face overdraft charges, daily limit fees, ATM withdrawal costs, balance inquiry charges, and a card replacement fee.

What security measures does Ally Bank have in place to protect my Debit Card?

Ally Bank safeguards your debit card with card encryption, fraud monitoring, and online security. They also have mobile app protections and use two-factor authentication to ensure only you can access your account.

Wrap Up

In conclusion, activating your Ally Bank Debit card is a breeze. It’s simple and can be done online or over the phone. Don’t forget, around 70% of Americans prefer to handle banking tasks digitally, according to a 2019 American Bankers Association survey. You’re now part of that savvy group!

So take advantage of your activated debit card and enjoy the benefits it offers! If you encounter any issues, don’t hesitate to reach out to Ally Bank Support. They’re always ready to help you navigate financial waters with ease.